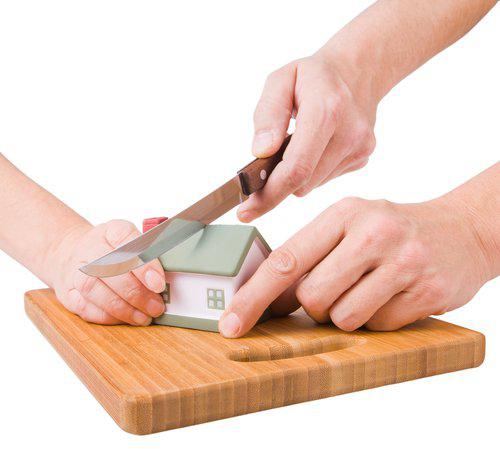

Property Division: When Is Fair, Fair?

Texas law requires that the property division in a high-asset divorce be a "just and right" division of the estate. Generally, such a division is made along an even or fairly even basis. But that is certainly not always the case, and both parties should be prepared to present a compelling case that protects their individual legal and financial interests, both in the short and long terms.

Texas law requires that the property division in a high-asset divorce be a "just and right" division of the estate. Generally, such a division is made along an even or fairly even basis. But that is certainly not always the case, and both parties should be prepared to present a compelling case that protects their individual legal and financial interests, both in the short and long terms.

Property division is further complicated by Texas' rather narrow spousal maintenance law. In many other jurisdictions, long-term alimony that is designed to balance the standard of living between the two spouses is at least an option. But that is not the case in Texas, unless the payee spouse has a permanent disability or some other impairment, is the custodian of a minor disabled child, or has been the victim of family violence.

What to Divide

Property in Texas is presumed to be community property and therefore divisible between the soon-to-be ex-spouses. To overcome this presumption, the challenging spouse must show by clear and convincing evidence that the property was acquired by gift or before the marriage.

Commingled property is often an issue; for example, Wife may use funds from her paycheck (community property) to make contributions to a retirement fund she had prior to the marriage (separate property). In such situations, the contributing estate may be entitled to reimbursement from the benefiting estate; in the above example, Wife might be ordered to pay Husband half the value of the contributions made during the marriage, which represents his share of the community estate's contribution.

How to Divide It

Once property is classified, it must be divided in a just and right fashion according to a list of factors that includes:

- Relative age, health, and economic circumstances of the parties;

- Fault in the breakup of the marriage, such as adultery or family violence;

- Current and future earning capacities;

- Custodial provisions for minor children;

- Potential future inheritances; and

- Tax consequences.

Additionally, the judge has the discretion to consider any other factor deemed relevant in the property division.

There are a number of issues involved in a high net worth divorce's property division. For a confidential consultation with an aggressive Round Rock high asset divorce attorney, contact our office. Mr. Powers is a Board-Certified family law expert.

Sources:

http://www.statutes.legis.state.tx.us/Docs/FA/htm/FA.7.htm#7.001

http://www.statutes.legis.state.tx.us/Docs/FA/htm/FA.3.htm#3.001

512-610-6199

512-610-6199